The UK gambling industry is set to rake in up to £1.8 billion extra over the course of the next year as cuts to dangerously addictive betting machines are postponed.

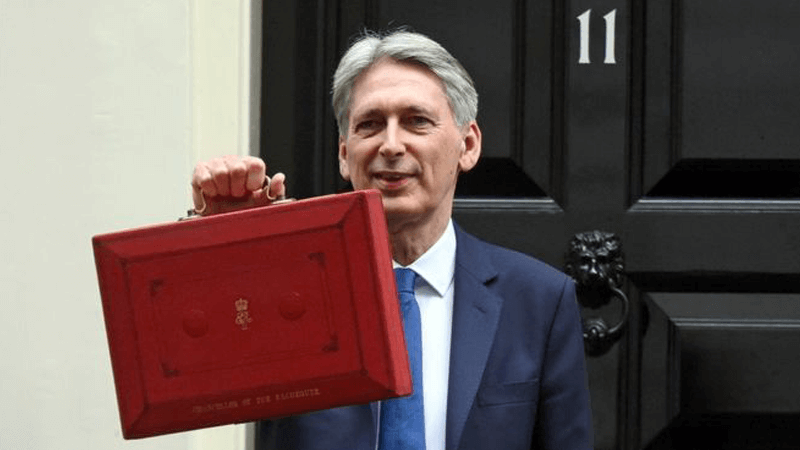

Chancellor Philip Hammond announced that the maximum stake on fixed-odds betting terminals (FOBTs) will not be cut until October 2019, despite a reduction being agreed in May.

The Budget announcement has been blasted by campaigners who say that the most vulnerable in society will be worst affected by the inaction.

Delay

Currently, gamblers can stake up to £100 every 20 seconds on the machines, but in May the Department for Digital, Culture, Media and Sport agreed the maximum stake should be cut to £2.

“wholly unjustifiable”

It said it expected the change to be implemented within nine to twelve months, but this delay extends the wait to almost 18 months.

The Treasury took £450 million last year in tax revenues from the machines.

‘Appalled’

Carolyn Harris MP, who is the Chair of the All-Party Parliamentary Group (APPG) on FOBTs said she was “appalled” by the announcement, adding that bookmakers “must be delighted”.

She said: “To delay cutting the stake on FOBTs to October 2019 is wholly unjustifiable. This will lead to many more vulnerable people’s lives being harmed while the bookmakers will continue to make millions from FOBT machines.”

The APPG’s Vice-Chairman Ronnie Cowan MP accused Hammond of colluding with bookmakers, saying the announcement “disregards the cross-party support on the issue and is the sort of dirty deal that gives politics a bad name”.

The Campaign for Fairer Gambling branded the delay “unacceptable”.

‘Missed opportunity’

Hammond also announced in his Budget speech that online gambling revenues would face a six per cent rise in tax, which would serve to offset the treasury’s loss of earnings from the FOBT cuts.

However, the Campaign for Fairer Gambling said the tax hike from 15 to 21 per cent did not go far enough.

“Increasing remote gaming duty was the correct decision, but a missed opportunity to not set it at 25% which would bring it into line with similar bricks and mortar gambling venues.”